Of first noted, is that all these deaths have been reported as suicides, which in itself is somewhat telling, and mystifying.

Secondly not one of these suicides involved the use of a gun. Take note that professional killers, rarely use guns, as today's police budgets have large amounts of funds designated on tracing bullets and guns to their owners.

Thirdly a large number of the deaths were from one brokerage firm, J.P. Morgan, and one large international insurer Swiss Re Ag. the world's second largest re-insurer.

The fourth point is that many of the deaths occurred on consecutive days. This again is very suspicious.

Aug. 26, 2013; Pierre Wauthier found dead. An employee of Zurich Insurance Group.

Jan. 11, David Bird goes missing. A 20 year veteran of following the commodity markets as a news reporter. Soon after he is declared missing all of his previously written articles have disappeared from the Wall Street Journal.

Jan.26, Tim Dickerson found dead. An employee of Swiss RE Ag

Sunday, Jan. 26: William Broeksmit, a 58-year-old former senior executive at Deutsche Bank AG, was found dead in his London home after an apparent suicide by hanging.

Monday, Jan. 27: Tata Motors managing director Karl Slym died after falling from a hotel room in Bangkok where he was staying with his wife.

Tuesday, Jan. 28: 39-year-old vice president in JPMorgan's investment bank’s technology department, Gabriel Magee, died after falling from the roof of the company's European HQ in London. Police initially reported that “thousands of horrified commuters” witnessed the death. Unable to produce a single one, police are now investigating. Wall Street on Parade (Feb. 23) reported, “Friends report that Magee was a happy, healthy, vibrant young man who emailed his girlfriend on the evening of January 27 to say he...would be home shortly.”

Wednesday, January 29: 50-year-old Russell Investments’ Chief Economist Mike Dueker died from apparently jumping over a 4-foot fence and from a ramp near a Tacoma, Washington bridge. His body was not discovered for days.

The week before, a U.K.-based communications director at Swiss Re AG died. The cause of death has not been made public. (The reference is to Tim Dickenson; the circumstances of his death are still undisclosed.)

Monday, February 3: 37-year-old JP Morgan executive in Equities Trading, Ryan Crane, died suddenly in his Stamford, Connecticut, home. The state’s chief medical examiner is determining the cause. When Wall Street On Parade called the Stamford Police to ask for the police incident report to which the press is legally entitled under Connecticut law, it was told “if we were able to obtain the incident report, most information would likely be redacted.”

Tuesday, February 18: 33-year old JP Morgan forex trader Li Junjie is the latest in a string of suicides to take his life in Hong Kong. No suicide note was found. Two days before his suicide, Junjie spoke of plans to return to Toronto, where he had worked at the Royal Bank of Canada.

Other names could be added to the Financial Post list:

December 15, 2013: 34-year-old JP Morgan employee in Client Technology Service Jason Alan Salais died in Texas of an apparent heart attack. According to the National Center for Health Statistics, the rate of heart attacks among men aged 20 to 39 is one half of one percent of the population.

February 4, 2014: 57-year-old founder and CEO of American Title Service Richard Talley died after apparently shooting himself with a nail gun. The Denver Post (Feb. 10) stated that he had shot himself seven or eight times in the head and chest. Talley and his company were being investigated by state insurance regulators at the time.

Death scene below in Hong Kong. A JP Morgan trader, apparently jumps to his death.

A puzzling point to all these deaths is that why would someone of a high degree of education and sophistication, commit suicide by jumping off a bridge or out of a office building? In one case the executive transferred $800 million dollars to family members weeks before his death. Why would these people be afraid of the court system, if they were fearing some legal action, when they had the funds to hire the best of lawyers with just a phone call away?

In one case the victim shot himself numerous times with a automatic nail gun. Does this sound like suicide or a form of torture?

What information or knowledge did these victims have that was so dangerous and valuable. Is there more deaths that have yet to be uncovered? An example is the Boeing 777 airline that just went down. A number of fraudulent passports were later discovered as passengers on that flight. Were these J.P. Morgan forex traders trying desperately to cover their tracks that needed to be eliminated?

What connection is there between J.P.Morgan and Swiss Re Ag.

J.P. Morgan's European headquarters at Canary Wharf London.

The first death was Pierre Wauthier, an employee of Zurich Insurance. A suicide note was found, but it was typed.

A typed suicide note is extremely rare. Suicide is a very emotional point in one's life, and to turn on the computer, then type a note, then plug in the printer, then hit print on the computer doesn't very often happen.

Prior to being employed at Zurich, Wauthier worked for J.P. Morgan for 11 years, as V.P. of Insurance Product Group. J. P. Morgan is the market maker in the Zurich Group, giving different weight analysis to different stocks and their performances. A very important position of authority. J.P. Morgan is also the investment bank for Zurich, and also is the asset manager for a number of funds offered by Zurich Insurance Group.

After the death of Wauthier, Zurich Group announced the appointment of G. Quinn to replace Wauthier. G. Quinn was formerly from the Swiss Re Ag Insurer.

Swiss Re Ag has had a long history with J. P. Morgan. In Jan 2010, Swiss Re obtained a $1 billion Letter of Credit from J.P. Morgan, and also served as Swiss Re's investment bank on many deals. In return Swiss Re and Zurich Group provided J.P. Morgan with liability insurance, which they seemed to need on a regular bases.

For several years US regulators have been trying to make sense on how J.P. Morgan Luxembourg S.A. was doing in it's "Whale Trades", that has lost $6.2 billion using depository money at FDIC insured banks.

According to an online analysis at Zurich Insurance Group’s web site, one JP Morgan's managed funds, the Global Natural Resources Fund, has lost 42.54 percent as of June 30, 2013, reflecting its performance since inception on April 2, 2012.

These 3 firms have been in several significant financial arrangement, some of which have brought fraud charges that resulted in out of court settlements.

What information would be so valuable that results in murder?

This information is the end game, survival of the world's elite wealthy class, that feel they have a sense of entitlement. This is the 1% of the world's population that controls 90% of the world's wealth and have no intention of falling into the madding crowd.

World currencies are about to be reset, to better reflect a countries wealth and debt ratio. This has extreme ramifications for the US dollar. As years of excess by America's once envied and coveted middle class, has resulted in their eventual commonality. This commonality will now be found in the form of a new universal working class. The US dollar is about to be devalued by 50%, while rising economies with positive current accounts will have their currencies move higher. This is Obama's grand plan of a common level playing field that the world is now demanding.

America's new working class will find the drudgery of daily living, as merely endless moments of cogs turning in a machine of wheels. Dreams of an idyllic future, and an endless supply of cheap consumer goods paid for by easy credit will now be covered by the devil's cloak. America's drug culture will be embraced by the legalizing of drugs to soften the impact of reality as America's new working class grapples with the prospects.

How will the elite survive with their wealth?

With the resetting of the US dollar, wealth has to be preserved in as asset that is not fixed to the dollar. The answer for this is purchasing real assets not based in America, and these assets are base metals. Base metals, Copper, Nickel, Zinc and Aluminium, are the building blocks of industry, and can be purchased as real assets, not as a future contract, or an derivative or an option, but as a real asset. If market conditions become extreme these type of paper contracts may not be worth the paper they're written on.

The London Metal Exchange, (LME) has been central to the base metal industry. LME gives out interest free loans to their select customers and arranges storage for their metals. How LME makes most of their money, other than transaction fees, is on extremely high storage fees? LME then has statistical data, on the amounts of base metals in storage, and pricing of these metals. To have this continual knowledge of a metals complete supply, and price is a great advantage in positioning your market plays.

These high storage fees eliminate contagio. A market condition when the future price is always higher than the existing price. A conditions that almost guarantees a continued line of profits. This is a manipulated market condition that existed a few years ago with oil pricing, when oil went over $150/barrel. Goldman Sachs was one of the major contributors to this market condition.

The London Metal Exchange

A number of international investment banks and large trading firms, have come up with a brand new plan.

Glencore a major Swiss trading firm, using it's metal warehouse company, Pacorini. Pacorini now is in control of 60% of the world's Zinc supply, and is warehousing it in difficult and rather unattainable locations.Their warehousing costs are far less than LME which creates an example for a market condition known as Contagio to occur.

Goldman Sachs, a NY Investment Bank, using it's metal warehouse company, Metro. GS and J.P. Morgan have entered into a warehousing agreement for base metals.

J. P. Morgan a NY Investment Bank, using it's metal warehouse company, Henry Bath

Both of these US Banks are now under overview by US regulators in what is seen a market manipulation, and both may be forced to sell their US interests in metal warehousing, but at the same time expand outside of the US. This in effect pushes the markets outside of the US dollar, as a major number of trades are now in Swiss Francs.

Julius Baer, a Swiss Investment Bank, and Credit Suisse have recently teamed up to warehouse copper and Zinc, using their own warehouses rents at much reduced costs than LME.

Metal warehouse.

The elite 1% will survive, while the world's currencies and markets are in turmoil, and come out the other side even more rich than before.

A new world awakens, a world I hope that I may not have to endure. A world of 2 classes of people. Those that hold the dreams and those that only can wish for them.

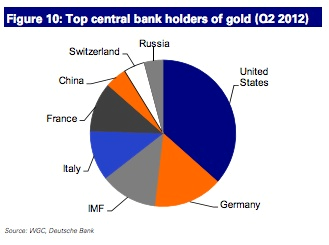

The Gold Connection

This article outlines why the US dollar has to be revalued lower, and a possible reason for the aforementioned deaths.